PTA Tax Calculator 2026: Check Mobile Tax on CNIC & Passport

Use our PTA Tax Calculator 2026 to find the exact PTA tax for any mobile phone in Pakistan.

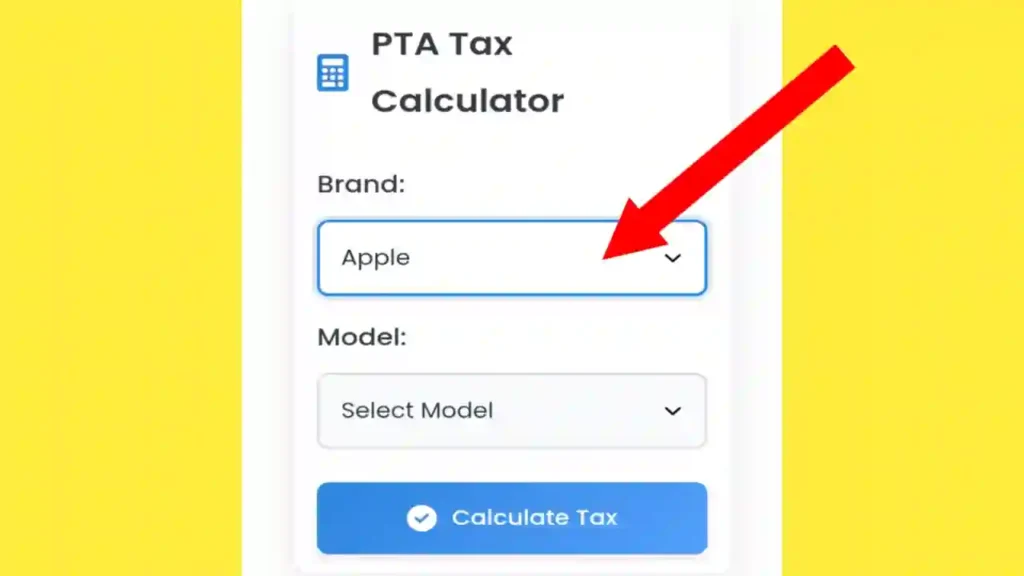

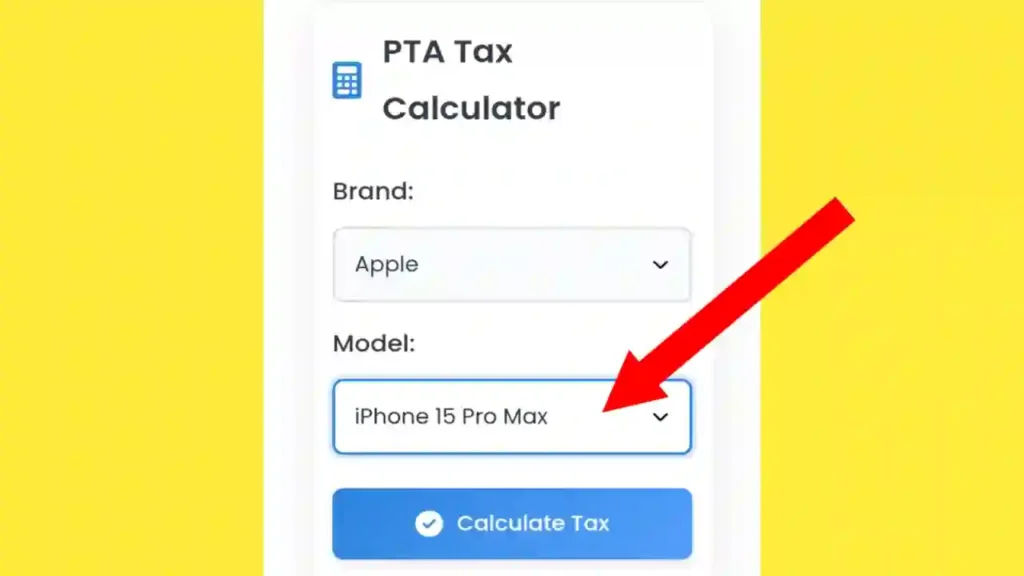

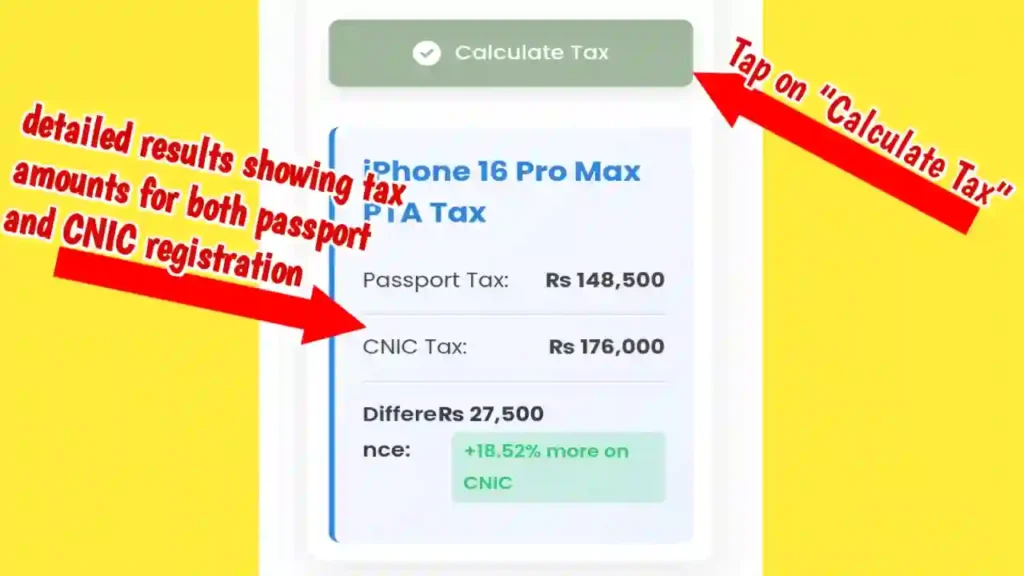

This free tool shows the PTA tax on CNIC and Passport in seconds. You only select the brand and model, then click Calculate Tax.

This calculator works for all phones including iPhone, Samsung, Xiaomi, Oppo, Vivo, Infinix, Realme, Google Pixel and more.

PTA Tax Results

Brands Covered in Our Calculator

- iPhone

- Samsung

- Xiaomi / Redmi

- Oppo

- Vivo

- Realme

- Infinix

- Tecno

- Google Pixel

- OnePlus

- Huawei

- Motorola

- Nokia

- Sony Xperia

How to Use the PTA Tax Calculator

Follow these easy steps:

- Choose Mobile Brand

Select your phone brand such as Apple, Samsung, or Xiaomi.

- Choose Mobile Model

Pick your exact model like iPhone 14 Pro Max or Samsung Galaxy S23.

- Click on Calculate Tax

The system shows PTA tax for:- Passport Registration

- CNIC Registration

You get the correct tax value instantly.

PTA Mobile Tax Rates on Passport – 2026

If you register your mobile phone using your passport within 60 days of entering Pakistan, your payable PTA tax is calculated according to your phone’s price in US dollars. The table below shows the applicable rates.

| Sr.No | Mobile Value in USD | PTA TAX in PKR |

|---|---|---|

| 1 | Up to $30 | 430 PKR |

| 2 | Above $30 and up to $100 | 3,200 PKR |

| 3 | Above $100 and up to $200 | 9,580 PKR |

| 4 | Above $200 and up to $350 | 12,200 PKR |

| 5 | Above $350 and up to $500 | 17,800 PKR |

| 6 | Above $500 | 27,600 PKR |

A 17% sales tax applies in addition to the listed PTA amounts. This extra tax is charged separately in Pakistani rupees.

PTA Mobile Tax Rates on CNIC – 2026

If you register your phone using your CNIC, the PTA tax depends on your mobile phone’s value in US dollars. These 2026 rates are based on the latest data released by FBR for users in Pakistan.

| Sr.No | Mobile Value in USD | PTA TAX in PKR |

|---|---|---|

| 1 | Up to $30 | 550 PKR |

| 2 | Above $30 and up to $100 | 4,323 PKR |

| 3 | Above $100 and up to $200 | 11,561 PKR |

| 4 | Above $200 and up to $350 | 14,661 PKR |

| 5 | Above $350 and up to $500 | 23,420 PKR |

| 6 | Above $500 | 37,007 PKR |

A 17% sales tax applies in addition to the listed PTA amounts. This extra tax is charged separately in Pakistani rupees.

Benefits of Being on ATL

- Pay 50% less tax

- Faster approval

- Lower total cost

What Is PTA Mobile Tax?

PTA mobile tax is a government duty on imported mobile phones in Pakistan.

If your phone is not PTA approved within 60 days, PTA blocks your SIM services.

The tax depends on:

- Phone price

- Registration type (Passport or CNIC)

- Your ATL status (Active Taxpayer)

Why You Must Check PTA Tax

- Avoid SIM blockage

- Save money with correct tax

- Know exact payable amount

- Register your phone smoothly

PTA Tax Formula

PTA Tax = (Mobile Price × Tax Rate) + (Customs Duty × 1.17)Example PTA Tax Calculation

Phone price = PKR 50,000

Tax rate = 20%

Customs duty = PKR 5,000

Tax = (50,000 × 0.20) + (5,000 × 1.17)

Tax = 10,000 + 5,850

Tax = 15,850 PKRTotal PTA Tax = PKR 15,850

How to Check PTA Tax by IMEI

- Insert SIM card

- Dial *8484#

- Enter your mobile number

- Enter CNIC

- Enter IMEI (*#06#)

- Submit

You will receive PTA tax details by SMS.

How to Check PTA Approval Status

By SMS

- Send your IMEI to 8484

By Website

- Visit PTA DIRBS portal

- Enter IMEI

- Click Check

How to Pay PTA Mobile Tax Online Step-by-Step Guide

To avoid your device being blocked after 60 days, follow this registration process:

- Create a DIRBS Account: Visit the official PTA DIRBS portal and sign up as an ‘Individual’.

- Generate PSID: Enter your phone’s IMEI (Find it by dialing *#06#). The system will generate a Payment Slip ID (PSID).

- Payment: Use the PSID to pay the tax via Online Banking, ATM, or by visiting a physical bank branch (Allied Bank, Bank Alfalah, etc.).

- Confirmation: Once paid, your device status will update to “PTA Approved” within 24 hours.

Quick IMEI Verification Methods

Check if your phone is already approved or see the tax status using these methods:

- Via SMS: Send your 15-digit IMEI to 8484.

- Via Web: Visit the PTA DIRBS Website.

- Via App: Download the DIRBS app from the Play Store or App Store.

Disclaimer

Tax rates are subject to change by the FBR based on currency fluctuations (USD to PKR) and new government policies. Our calculator provides an estimate; for the final official amount, always refer to the PSID generated by the PTA portal.

FAQs

How many days do I get to register PTA?

You get 60 days after arrival in Pakistan.

How to check PTA tax for my phone?

Use our calculator or send IMEI to 8484.

Is PTA tax same on passport and CNIC?

No. Passport tax is always lower.

How do I find my IMEI?

Dial *#06# on your phone.

What is PSID?

PSID is your PTA payment slip ID.

Can I pay PTA tax through EasyPaisa?

Payment methods change. Bank branch is safest.

How many phones can I bring to Pakistan?

Only one phone is allowed duty-free.

How to PTA approve iPhone?

Register IMEI on DIRBS → Generate PSID → Pay tax.